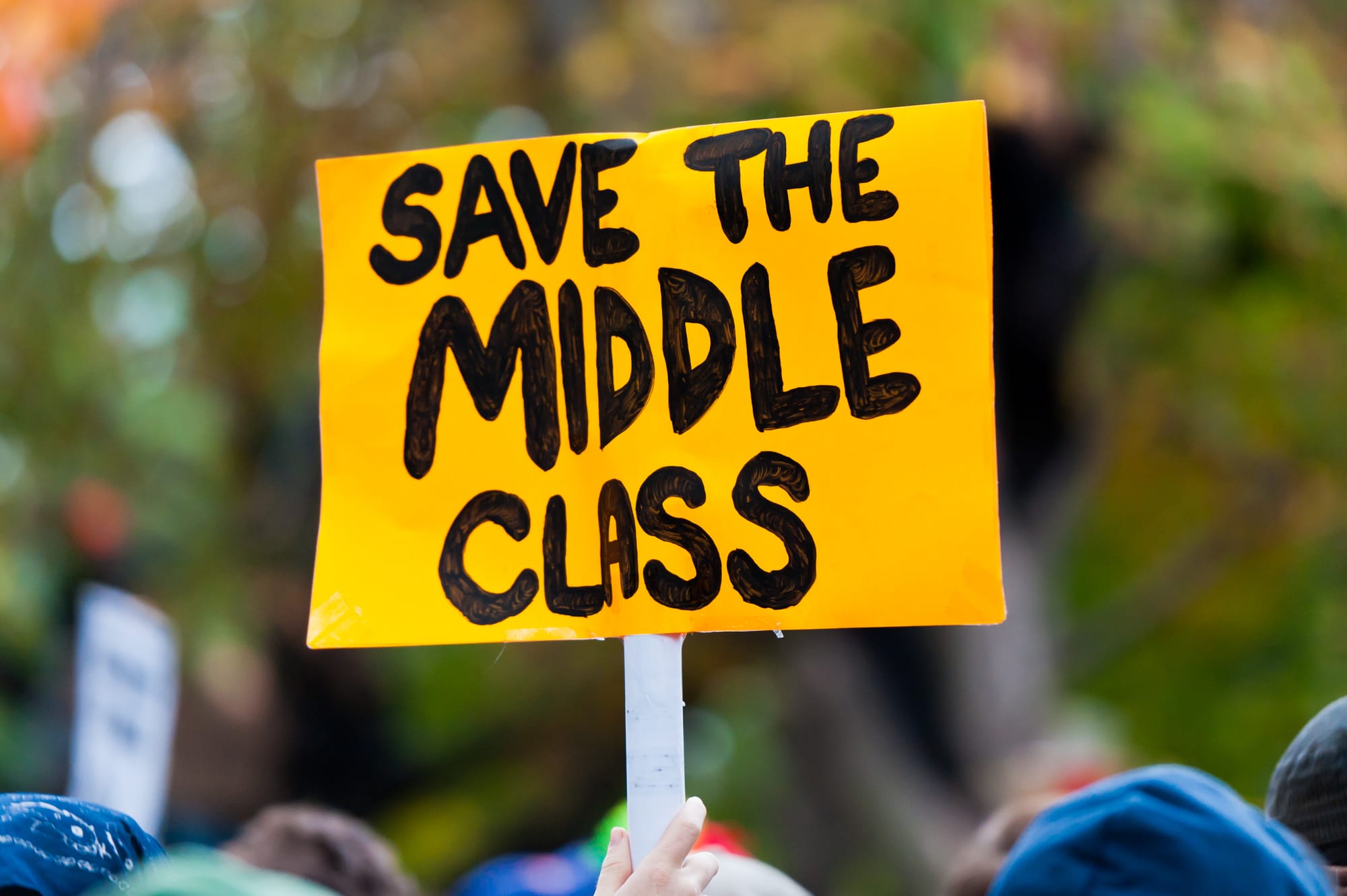

The middle class is going broke over basics

The phrase "middle class is going broke over basics" highlights the increasing financial pressures faced by middle-income families as they struggle to afford essential goods and services. This phenomenon is exacerbated by rising living costs, stagnant wages, and inflation outpacing income growth. Below are elaborations and examples of how this plays out in daily life:

1. Housing Costs

Elaboration: Rent and mortgage payments are consuming a larger share of household income. In many urban areas, the middle class is priced out of affordable housing, forcing them into financial strain or less desirable living situations.

Example: A family in Gaborone earning an average income may spend over 40% of their monthly earnings on rent, leaving little for other necessities like food, education, and healthcare.

2. Food Prices

Elaboration: Inflation in food prices has made even staple items like bread, milk, and vegetables increasingly expensive. Middle-class families now spend a higher percentage of their budget on groceries.

Example: A grocery basket that cost P500 in Botswana a year ago now costs P700 due to rising import costs and supply chain disruptions.

3. Healthcare Expenses

Elaboration: Even with insurance, the cost of medical care is rising. Prescription drugs, specialist visits, and emergency care can create financial stress for families without adequate savings.

Example: A parent might forego routine dental checkups for their children because the out-of-pocket costs exceed what their insurance covers.

4. Education Costs

Elaboration: Tuition fees, school supplies, and extracurricular activities are becoming prohibitively expensive. Middle-class parents may have to choose between sending their children to quality schools or paying for other essentials.

Example: A family might opt for a less prestigious school because they cannot afford the P30,000 annual tuition for a private institution.

5. Transportation

Elaboration: Rising fuel prices and the cost of maintaining vehicles add to the financial burden. Public transport may not be reliable or widely available in some areas.

Example: A worker commuting daily in Botswana might now spend P2,000 per month on fuel, compared to P1,500 a year ago, reducing disposable income.

6. Utility Bills

Elaboration: Electricity, water, and internet costs are increasing, adding strain to middle-class households.

Example: An average household electricity bill might have risen from P800 to P1,200 per month due to rate hikes, forcing families to cut back on other expenses.

7. Debt and Financial Insecurity

Elaboration: Many middle-class families rely on credit cards or loans to bridge gaps, leading to long-term debt. Emergencies, like car repairs or medical bills, often push families further into financial distress.

Example: A family with a P10,000 monthly income might already have P50,000 in consumer debt, making it impossible to save or invest for the future.

Broader Implications

Economic Impact: When the middle class cuts back on spending due to financial stress, it reduces economic growth and consumer demand.

Social Stress: Financial pressure can lead to mental health issues, family conflicts, and reduced quality of life.

Solutions

Governments and policymakers could address this issue by:

Subsidizing essentials like healthcare, education, and housing.

Implementing wage growth policies to match inflation.

Reducing taxes for middle-income families or offering rebates.